Choosing the right legal structure is a necessary step in running a business. The business structure you choose affects everything from day-to-day operations to taxes, and how risky your personal assets are. You should choose a business structure that gives you the right balance of legal benefits and protections. So what is the Business Legal Structure? What factors should be considered when choosing a business legal structure? The answer will be in our article today.

What is the Business Legal Structure?

A business entity, often known as a corporate legal structure, is a type of organization that has authority over particular areas of your firm. Your business’s legal form affects your tax liability at the federal level. It could be subject to state-level legal repercussions. Sole proprietorship, partnership, corporation, and limited liability company are examples of popular business legal forms (LLC). The choice of structure will rely on a variety of criteria, including the size and nature of the firm, the number of owners, and the level of personal responsibility the owners are ready to accept. Each form of structure has benefits and disadvantages.

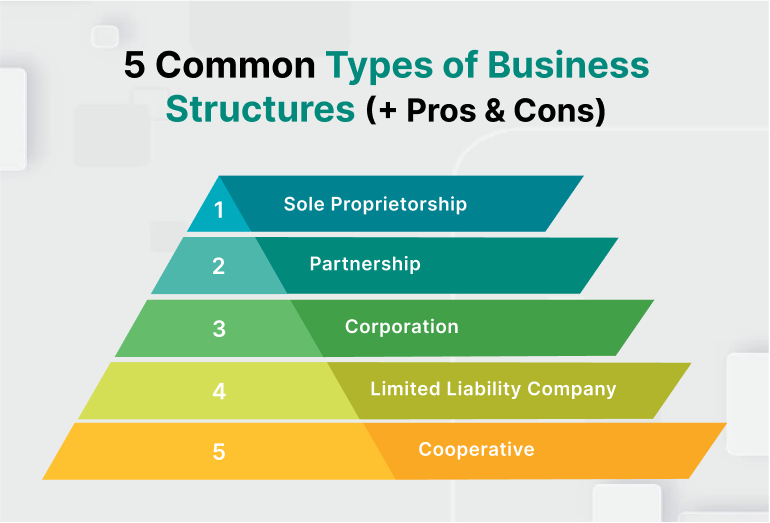

Common types of business structures

The most common types of business entities are sole proprietorships, partnerships, limited liability companies, corporations, and cooperatives. Below is more information on each type of legal structure.

Sole proprietorship

A sole proprietorship provides you total control over your firm and is simple to set up. You are automatically considered a sole proprietorship if you conduct business activities but are not registered as any other type of business. A sole proprietorship can be a good option for low-risk businesses and owners who want to test their business idea before setting up a more formal business.

Partnership

A partnership is the most straightforward type of shared ownership for two or more people. Limited partnerships (LPs) and limited liability partnerships (LLPs) are the two most prevalent forms of partnerships (LLP). Businesses with several owners, professional associations (like attorneys), and organizations looking to test a potential business idea before launching a full-fledged company may find that forming a partnership is a smart option.

Limited liability company

Your personal assets, such as cars, homes, and savings accounts, are usually protected from personal responsibility by a limited liability business, so in the event of bankruptcy or legal action might affect your limited liability corporation. For firms with medium to high levels of risk, owners who want to preserve their substantial personal assets, and owners who want to pay lower tax rates than they would with a corporation, a limited liability company may be a wise choice.

Corporation

The law considers a company separate from its owners, with legal rights independent of its owners. It can sue, be sued, own and sell property, and sell ownership in the form of shares. Corporate filing fees vary by state and type of fee. Companies can be classified as C corporations, S corporations, B corporations, closed corporations, nonprofit corporations, and more.

Cooperative

A cooperative is a company or group that is owned and run for the benefit of the people who consume its products or services. The cooperative’s members, also known as user owners, share in the profits and revenue it generates. Shares can be purchased by members to join the cooperative; however, the amount of shares a member owns has no bearing on the strength of their vote.

Choose a business structure: What to consider?

Here are a few crucial elements to take into account as you select the legal framework for your company:

- Complication: How sophisticated will your company be in the future? Do you want to keep up the one-man program, or do you want to expand your company and eventually sell it to investors?

- Legal protection: Being able to separate your business assets from your personal finances is an advantage if your business carries significant liability.

- Tax: Pass-through firms include sole proprietorships, partnerships, limited liability companies, and S corporations. This implies that profits are only taxed when given to the owner (s). Each year, a business files its own tax return and pays taxes on profits after paying salaries and other expenditures.

- Number and type of owners: You might wish to start your firm as a C corporation if your aim is to go public at some point. However, if you’re creating a company that you don’t intend to become public, you might want to make your decision based on the expected number of owners.

- Capital investments: Start a business if you need to raise money from a bank, venture capitalist, or investor. Compared to sole proprietorships, corporations have easier difficulty collecting outside investments.

- Licenses: You may require particular licenses and permits to operate in addition to officially registering your company organization. It may be necessary for a business to get municipal, state, and federal licenses, depending on the type of business and its operations.

Advantages and disadvantages of business structure

Sole Proprietorship:

- Pros: easy and inexpensive to set up, complete control to the owner, less paperwork.

- Cons: unlimited personal liability, difficulty in raising capital.

Partnership:

- Pros: more capital and resources, shared decision-making and workload.

- Cons: shared personal liability, and potential conflicts among partners.

Corporation:

- Pros: limited personal liability, ability to raise capital through stock offerings, continuity of existence.

- Cons: complex tax rules, greater legal and financial requirements, potential double taxation.

Limited Liability Company (LLC):

- Pros: limited personal liability, pass-through taxation, flexible management structure.

- Cons: more expensive to set up and maintain, may be subject to more stringent regulations.

Conclusion

Deciding to Choose a business structure is an important decision for any entrepreneur. The type of structure you choose will affect the way you operate your business, how you are taxed, and your personal liability. Each structure has its own advantages and disadvantages, and it is important to consult with an attorney or accountant before making a decision. Ultimately, the best business structure for you will depend on your specific circumstances and goals for your business.