Business insurance is a type of insurance that helps protect businesses and their owners from potential financial losses that can result from unexpected events or situations. There are different types of business insurance policies, and the specific coverage a business needs will depend on the nature of the business, its size, and the risks it faces. Today we are going to learn about all that is involved in business insurance.

What is Business Insurance?

Business insurance is a type of insurance that helps protect businesses and their owners from potential financial losses that can result from unexpected events or situations. There are many types of insurance for businesses including property damage, liability and employee-related perils. Companies assess their hedging needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Business insurance policy

A business insurance policy is a legal contract between a business and an insurance company that outlines the coverage provided by the insurance company in the event of a covered loss. Business insurance policies can cover a wide range of risks and losses that a business may face, including property damage, liability, business interruption, professional liability, and employment practices liability.

There are many different types of business insurance policies available, and the specific coverage a business needs will depend on the nature of the business, the size of the company, and the risks it faces. Business insurance policies typically include the following elements:

- Insured parties: The policy will identify the business and any other parties that are covered by the policy.

- Coverage limits: The policy will specify the maximum amount that the insurance company will pay for a covered loss.

- Exclusions: The policy will list any exclusions or circumstances in which the insurance company will not provide coverage.

- Deductibles: The policy will specify the amount that the business must pay out of pocket before the insurance company will cover a loss.

- Premiums: The policy will outline the amount that the business must pay in order to maintain coverage.

Business insurance coverage

- Property damage: Business insurance can cover the cost of repairing or replacing physical property, such as buildings, equipment, and inventory, that is damaged due to a covered event, such as a fire or natural disaster.

- Liability: Business insurance can provide protection against financial losses resulting from claims of negligence or wrongdoing. This can include coverage for legal costs, damages awarded to the plaintiff, and other expenses related to a lawsuit.

- Business interruption: Business interruption insurance can cover the financial losses a business may incur as a result of being unable to operate due to a covered event, such as a natural disaster or power outage.

- Professional liability: Professional liability insurance, also known as errors and omissions insurance, can cover a business against financial losses resulting from errors or omissions made by the business or its employees.

- Employment practices liability: Employment practices liability insurance can cover a business against claims of discrimination, harassment, and other employment practices liabilities.

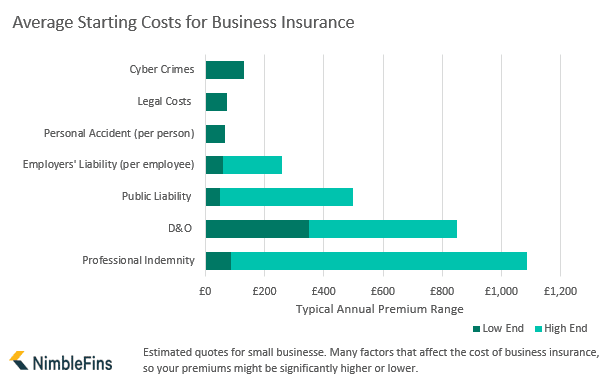

Business Insurance costs

The cost of business insurance will vary depending on a number of factors, including the type and amount of coverage a business needs, the size of the business, the industry in which the business operates, and the location of the business. Business insurance premiums are typically based on the level of risk that the insurance company believes the business is exposed to. Factors that can impact the cost of business insurance include the type of business, the location of the business, the number of employees, the amount of property and assets that the business owns, and the potential for liability.

Businesses with higher levels of risk may pay higher premiums for their insurance coverage. For example, a business that operates in a high-risk industry, such as construction, may pay higher premiums than a business in a low-risk industry, such as consulting. Similarly, a business that operates in an area prone to natural disasters may pay higher premiums than a business in a location with fewer risks.

Benefits of business insurance

Drawbacks of business insurance

Conclusion

Overall, business insurance can provide valuable protection for businesses and their owners, helping to mitigate financial risks and allowing businesses to operate with confidence. While business insurance can provide valuable protection for businesses, it’s important for businesses to carefully evaluate their insurance needs and be aware of the potential risks of business insurance.