What is a joint stock company? Joint stock companies are usually formed to help a business grow. The company will not be able to finance itself if only a small number of shareholders are involved. However, by working together, individuals can create a successful company, with each shareholder then anticipating financial benefits from the company’s success. In this blog, you will find information about Joint Stock Companies.

What is a Joint Stock Company?

A joint stock company is a business that is jointly owned by all of its owners. All parties here own a particular share of stock, which is typically represented as shares. If the company is a public company, its shares will be offered on a recognized stock exchange. A joint stock company’s shares can be transferred. Shares of private equity firms may be transferred between parties. Nevertheless, the agreement and family members restrict the transfer.

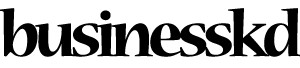

Features of Joint Stock Company

- Separate legal person

The legal identity of a business and its members is distinct, as opposed to ownership or partnership. Once incorporated, the company acquires its own legal identity. Therefore, a member of the company is not liable to the company. - Unify

In order for a company to be accepted as a separate legal entity, it must be incorporated. Therefore, registration of the establishment of a company in the form of a joint stock company is mandatory. - Limited

In this type of corporation, the liability of the shareholders of the company is limited. However, no member can liquidate personal assets to pay the debts of the company. - Number of Members

Specific laws govern the number of members a company can have. The minimum number of members in a public company is seven and the maximum number is unlimited. Two or more members must establish a private limited company. - Shares are transferable

Shareholders of the company without consulting can transfer their shares to others. Whereas, in a partnership without the approval of other general partners, a general partner cannot transfer his share.

Types of Joint Stock Company

Registered Business

An organization formed by registration under the laws of the company will be subordinate to a registered company.

Chartered Company

A unique legislative act passed on the direction of the president or the prime minister creates these corporations. The authority, responsibilities, and duties of such an entity are set forth by legislation. These companies exist to carry out a variety of significant national business operations.

Statutory Company

A charter company is a firm that has been formed by the king or another head of state. Historically, chartered firms possessed particular rights and interests because they were founded with assistance from the king’s administration; these organizations are frequently found in nations with monarchies as the ruling system. Examples of Chartered Companies include the Bank of England, the East India Company, and the British South Africa Company.

What are the Advantages of a Joint Stock Company?

- Honest

It is managed by legal authorities and put into effect by law. There is therefore no opportunity for fraud or deceit. The public is encouraged to have faith in the company’s operations by the annual release of financial statements and the auditing of company accounts by auditors. - Economic efficiency

The company will experience economies of scale in a number of areas, including purchasing, management, distribution, and sales, as a result of its expanding activities. Because of these economies, customers can purchase goods for less money. - Good investment

Given that the government regulates them, investing in joint stock companies can be a fantastic way to raise money. These equities are also low risk due to the professional managers’ use of their knowledge and abilities. - Limited liability of members

In limited liability companies, shareholders are protected. Business losses cannot affect personal or shareholder wealth.

Example of Joint Stock Company

A joint stock company is a type of business entity in which ownership is divided into shares of stock that are publicly traded or owned by individual investors. A joint stock company can raise capital by selling shares of stock to investors, and the owners of the stock benefit from any profits the company earns.

An example of a joint stock company is the Coca-Cola Company, which is one of the world’s largest beverage companies. Coca-Cola’s stock is publicly traded on various stock exchanges, and individuals can buy shares of the company to become partial owners. The company uses the capital raised from the sale of stock to fund operations and growth initiatives. As the company grows and generates profits, the value of the stock increases, which benefits the shareholders.

Conclusion

To sum up, joint stock firms are a well-liked structure for businesses that helps both the company and its shareholders. Overall, joint stock firms provide businesses with a flexible and efficient way to generate capital as well as a mechanism for individuals to invest in a company and maybe profit from their investment. Before making an investment in a joint stock firm, it’s crucial to thoroughly weigh the risks and advantages.