When a person decides to set up a business, one of the first things they have to do is decide what type of business structure to have for their company. In fact, there are 5 main types of business organizations to choose from. Organizing your business is the most important choice you will make for your company. The form of business you adopt will influence a multitude of factors, many of which will determine the future of your company.

The legal structure of your business determines how you are taxed, what your liabilities are, and how you secure funding and capital, among many other factors. If you enter into a business partnership, your structure will be different than if you just formed a corporation or limited liability company. Tailoring your goals to your types of business organization is an important step, so understanding the pros and cons of each is important. So we have this article to analyze each type of business for you.

What are the types of business?

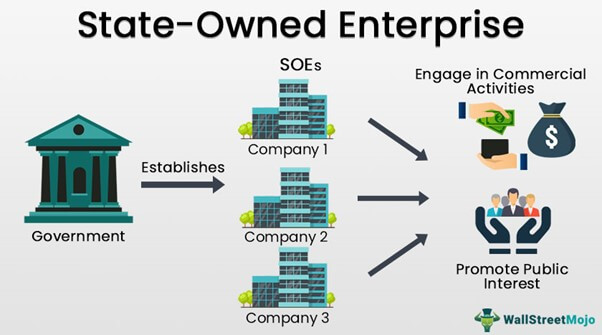

State enterprises

State-owned enterprises are enterprises in which the State holds 100% of the charter capital or more than 50% of the total voting shares. This type of enterprise is usually large-scale and organized in forms such as parent company, subsidiary company and economic group. Operating mainly in key economic sectors such as the national power transmission system, hydroelectric power plants, lottery…

Private enterprise

A private enterprise is defined as an enterprise owned by an individual or other private enterprise (including foreign organizations and individuals), an enterprise in which less than 50% of charter capital is held by the State, or a total number of shares with voting rights. This business structure is very diverse in size, but mainly small and medium-sized enterprises. They operate in regulated industries and are not allowed to engage in exclusive business lines reserved for state-owned enterprises.

Joint stock company

A joint stock company is a business entity in which shares of the company can be bought and sold by the shareholders. Each shareholder owns shares of the company in proportion, as evidenced by their shares. Shareholders can transfer their shares to others without affecting the continued existence of the company. Therefore, joint stock companies are often referred to as corporations or limited companies.

Partnership

The partnership is a sole proprietorship with two or more owners. Each of these owners or partners contributes to the business through sponsorship, property, labor, skills, or something similar. They also share in profits from the company and are 100% responsible for business debts. A general partnership can be formed informally by an oral agreement or formally by a written partnership agreement. However, it is generally a good idea to have a written partnership agreement. Taxes are imposed on the personal income of each business owner, not the revenue of the business.

Limited Liability Company (LLC)

A limited liability company, or LLC, is a newer type of business that is a mix of partnership and corporation. Instead of shareholders, LLC owners are called members. No matter how many members a particular limited liability company has, there must be one managing member who handles the day-to-day business operations. In an LLC, members are not personally responsible for the company’s business decisions or actions. Limited liability companies are one of the most popular types of online businesses, as they allow small groups of people to easily form a company together.

How to choose the right business structure

A company’s choice of business structure can have a lasting impact on how the business is run and operated, and how taxes are paid. Here are some questions you need to ask yourself to choose the right type of business for your company:

- How much debt and responsibility can you handle? The personal liability connected with a sole proprietorship or partnership is typically accepted by small enterprises and startups as a necessary business risk. By requesting a more formal corporate structure, you can reduce your personal liability if you operate in a high-risk field.

- How do you want to pay taxes? To keep things simple, you have two options when it comes to filing business taxes: you can file your business profits/expenses on your personal tax return, or you can file your business taxes separately as an entity. private. Most small business owners enjoy the simplicity of filing taxes on their own returns, but filing business taxes separately can help you separate your personal and business finances.

- Do you have partners or investors? If you are starting a business with a private partner or investor, you will not be able to set up a sole proprietorship. You can choose between a partnership (in which all responsibility and liability are shared equally), a limited partnership (which allows you to assign responsibilities and liabilities to each member) or a limited liability company (to protect all members from personal liability).

- Do you plan to hire staff? Some types of simple businesses can make it as difficult to hire as a sole proprietorship. if you already have employees or plan to hire employees, register a formal business structure such as a limited company or corporation.

- Are you in a for-profit business? If you are only interested in helping others and are not operating for profit, setting up a nonprofit organization may entitle you to a tax exemption.

Conclusion

To sum up, we have analyzed 5 different types of businesses available in the market. Every e-commerce business is different, so there is no “best” form of business organization to start with. Sit down and scrutinize your business plan to determine what the long-term future of your company will look like. This will help you better decide what type of business to pursue, based on the needs of the business itself. Was this article helpful to you? We hope that with the above information, you have a clearer view of the types of businesses.

Read more: